Contents:

These are well-established companies with a significant market share. According to SEBI, listed companies ranked from 1st to 100th depending on market capitalisation are called large-cap. Moreover, listed companies ranked from 101st to 250th are called mid-cap, and those ranked from 250th onwards are called small-cap. There are quite a few factors which impact the market cap of a company. Learning these factors can aid investors in judging if a specific company is expected to offer good returns. Typically, these companies have reached the pinnacle of their growth, and as a result, there is a lesser chance of any drastic change in stock prices.

At certain times, they have plainly shown defiance at the pessimistic attitude of the international markets. India’s overall weight has risen within the MSCI Emerging Market Index. This has openly been a winner against its heavyweight neighbour, China. If this is placed within the context of the Indian economy’s recovery with regard to growth, the sentiment of the stock markets can be fully justified.

Market Capitalisation vs Free Float Market Capitalisation

The recent IPO glut has added to the market cap without disturbing the GDP. In reality, if you want to develop a Web 3.0 architecture that’ll require huge funding and extraordinary people with extraordinary skillsets. Even if an Indian company wants to explore Web 3.0 they will not spend much on the valuable resources, whereas the US companies are willing to spend a huge amount and will provide RSU on top of it.

Britain’s exit from the European Union, Donald Trump’s surprise win in USA, demonetization, and GST in https://1investing.in/, relying on any one indicator to deploy or employ money is unsuitable. Invest in stocks with Free Expert Advice only with MO INVESTOR. In its model portfolio, it maintained its overweight stance on BFSI, auto, Consumer and IT sectors while it maintained its underweight stance on energy, pharma and utilities. US m-cap share stands at 45 per cent of the world’s m-cap, China’s 9.6 per cent, Japan 5.3 per cent and Hong Kong 4.3 per cent.

Nationwide vaccination drive, easing out of lockdown curbs, and signs of economic recovery in the future are possible reasons the market to celebrate. But this celebration is only for fundamentally strong companies. On the other hand, GDP reflects the pain in the informal sector, where the recovery is painstakingly slow. The impact of Covid 19 has been more severe on the informal sector. One can still see the flashes of the sight when thousands of migrant labourers were forced to travel on foot. Specifically in India, though the contribution of agriculture and industries to GDP and their representation in the stock market performance is declining over the period, it is still the largest employer.

Ways to Stay Away from Pump and Dump Stocks

The 3 major types of stocks which investors go on to invest in are discussed in further detail underneath. Top companies by market cap, along with the high-risk investments in developing enterprises. What this suggests clearly is that sound businesses with a legacy of performance can continue to grow and thrive over time, making them safe, steady compounders for investors. So, when in doubt about where to invest, think of companies with strong, well-established, time-tested businesses. Since it was tough to find historical price data for all these companies, we decided to evaluate their performance since when we could source corporate action-adjusted data.

- However, the indicator remains much above its long-term average of about 79%.

- Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner.

- Because this indicator completely ignores the rise in private equity investments.

Similarly, if you had sold out at P/E ratios of above 25 in 2007 and 2010, you would have managed to buy back into the market at lower levels. It only considers the total earnings of listed companies in the market. What about many large companies and businesses that are either government owned or are not listed? Over the past 30 years, the Sensex has risen from less than 1,000 to more than 50,000, a CAGR of 14.9 percent. The number is 13.4 percent for the past 20 years, 11.9 percent over the past 10 years, and 14.6 percent over the past five years.

Bottomline: Lessons for investors from India@75

In the present situation, however, this relationship seems to be failing. So how can one make sense of the long-term relationship (or the lack of one!!) which runs counter to our received wisdom. Looking at the same numbers for India exhibits an interesting pattern.

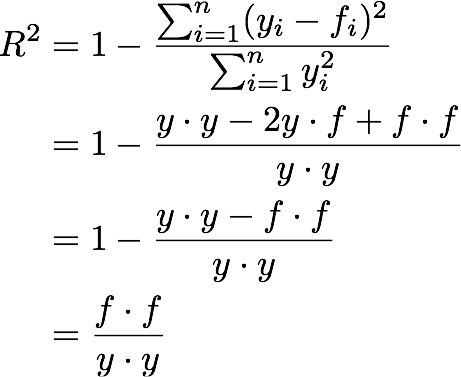

Fluctuating market conditions and stock prices also impact the evaluation of a company when this method of evaluation is being used. For investors, understanding the value of a company is imperative while creating a long-term investment plan. There are 3 things you need to be wary of before using this measure. Essentially this becomes ratio of a stock to a flow, almost like the Price to Sales ratio. Hence, the numerator and the denominator may not be strictly comparable. Thirdly, a lower Market Cap / GDP ratio is not always a sign of undervaluation.

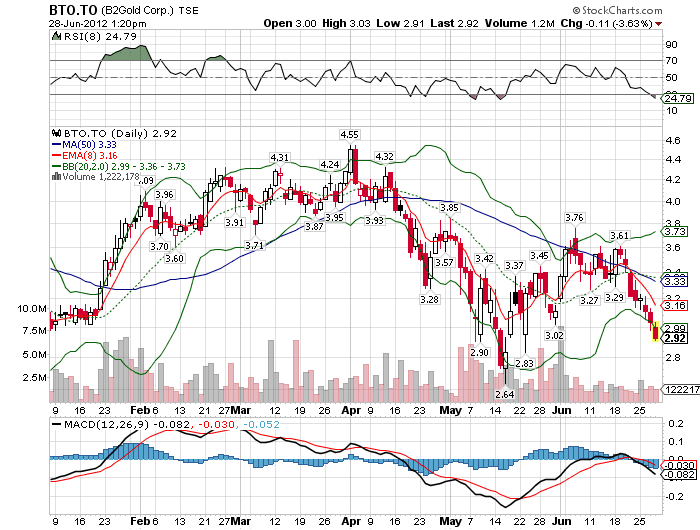

Expect more rate hikes; GDP can come down 1-1.5%: Ajay Piramal

You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. Stocks with a lower free-float market capitalisation are more volatile than those with a higher free-float market capitalisation. Thus, it’s best to use the market cap to GDP ratio with other economic indicators to ensure that you’re making an informed decision. This is true for technical indicators like Anchored VWAP and Bollinger Bands as well.

- His area of research is international and Indian economic policy.

- This triggers the fundamental demand-supply dynamics in the stock market and pushes the stock prices higher.

- You can check about our products and services by visiting our website You can also write to us at , to know more about products and services.

- What is the current ratio of market capitalization/gdp in india.

I agree to the processing of my personal information for personalized recommendations, personalized advertisements and any kind of remarketing/retargeting on other third party websites. Full access to our intuitive epaper – clip, save, share articles from any device; newspaper archives from 2006. Pick your 5 favourite companies, get a daily email with all news updates on them. Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app. Let’s also look at 3 other indicators to find out how expensive is Nifty at this stage.

A liquidity surplus is pushing stock price values higher globally. In India, it is being accentuated by domestic investors that have been investing in equity mutual funds. Indian economy is at a pivotal time of formalization of the economy where informal business dealings and sectors will evolve to metamorphose into an organized form providing an impetus to the growth of the organized economy. Investors should understand that the listed companies on the stock exchange form a part of this formal segment of the economy. The formalization of the economy is being achieved by major reforms by the government that include demonetization and implementation of the destination-based tax, GST.

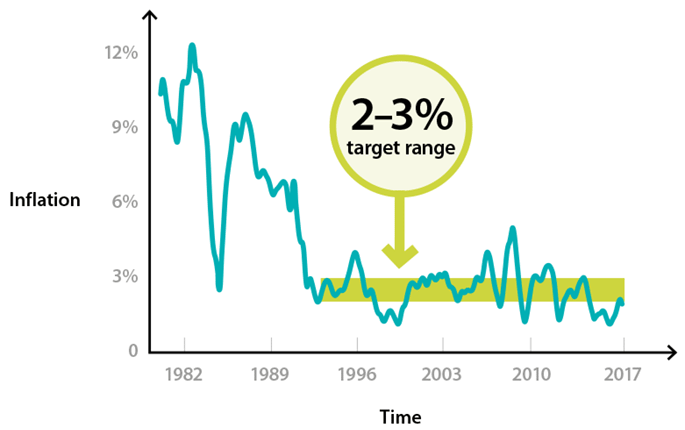

The indicator value for India stood at 105 level as of October end, based on FY23 projected nominal GDP levels. This is even as the 12-year average indicator value for India stands at only 79 level, suggesting the domestic stocks are overvalued. But the stock market isn’t a sandwich – it’s vast and diverse with companies from sectors like finance, pharma, and others.

Fed Chair’s testimony, FII flows among 10 factors to determine market movement this week – The Economic Times

Fed Chair’s testimony, FII flows among 10 factors to determine market movement this week.

Posted: Sun, 05 Mar 2023 08:00:00 GMT [source]

It is the highest since December 2008, when it had hit an all-market cap to gdp ratio india high of around 150 percent. A non-promoter shareholding of 25% sounds like good public policy but it is of little use if this doesn’t result in an adequate liquidity in the secondary market. Nilesh Shah says the Indian banking system is in a far better position. For example, SVB, out of their $200 odd billion balance sheet, could put $100 billion into the HTM category. The Reserve Bank of India caps how much you can put into the HTM category. In India’s case, the deposit base is widely distributed geographically, as well as across various industries.

Sensex@all-time high: Buffett smell test shows Indian equities fairly valued amid frothy global markets – Moneycontrol

Sensex@all-time high: Buffett smell test shows Indian equities fairly valued amid frothy global markets.

Posted: Thu, 24 Nov 2022 08:00:00 GMT [source]

He had set up the research desk at Fintrekk Capital across multiple asset classes. In his previous stints, he has worked as a business consultant and analyst with leading MNCs and start-ups over diverse fields of Healthcare, Education and Retail. So the present argument that the Indian market is “expensive but nowhere closer to bubble territory” based on historical PE ratio and Buffet Indicator trends, may become totally redundant.

Recent Comments